20

|

2016

|

2017 HOTREC ANNUAL REPORT

2016 KEY FIGURES FOR RESTAURANTS AND

BARS IN SELECTED EUROPEAN COUNTRIES

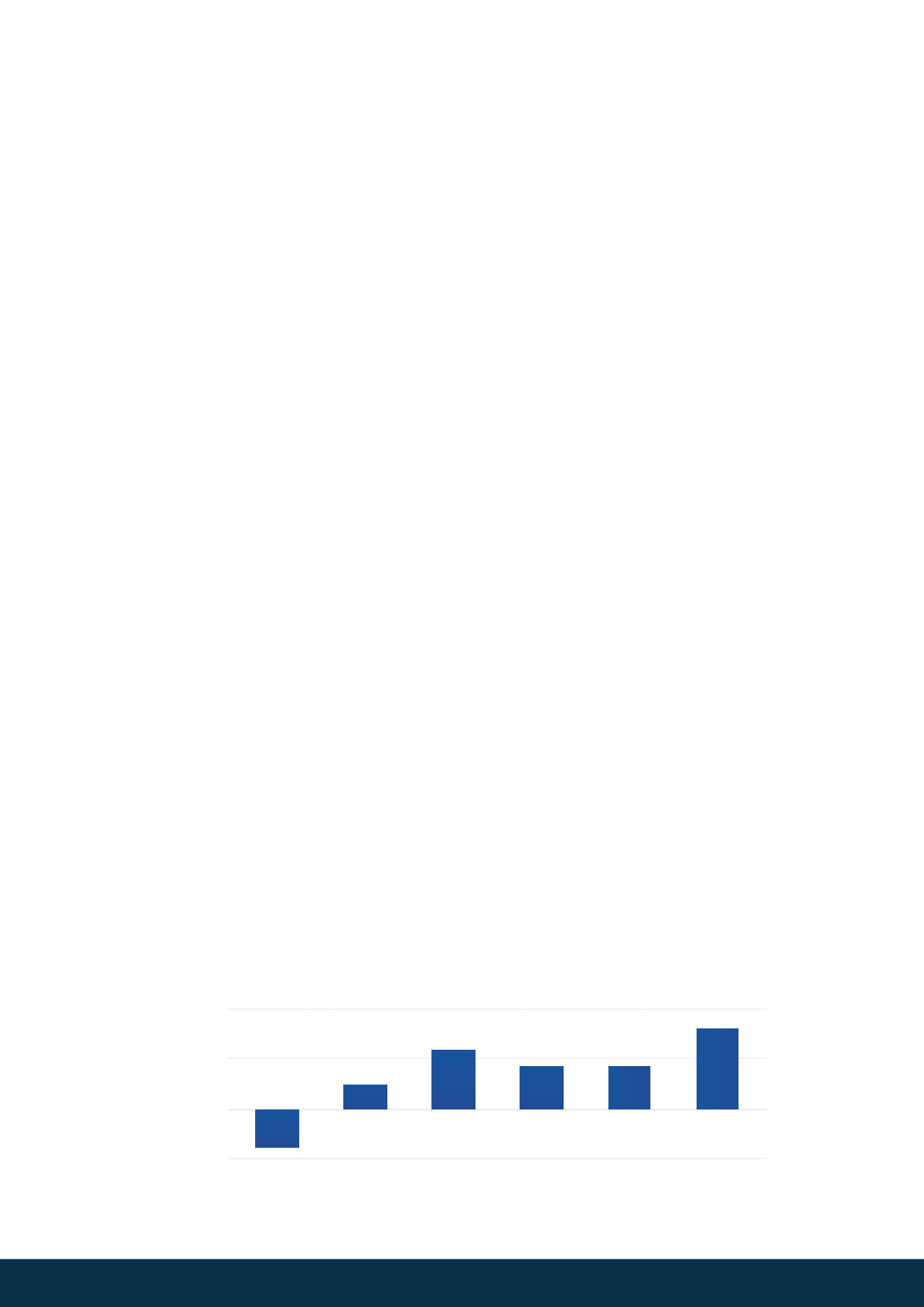

In 2016, restaurants experienced a strong raise in turnover in several European countries.

Austria: contrasted performances

As in the previous years, the sector experienced contrasted trends, with a decline in the number of inns (-6%),

cafés (-2.34), café-restaurants (-1.73%) and bars/discotheques (-0.29%). However, the number of classical

restaurants grew sharply by 5.85%.

Finland: mixed performances for the restaurant sector

The forecasts show contrasting trends for 2016, with a number of restaurants growing by around 1.4%, while

employment in the sector decreased by 1.09%.

France: a sector hit hardly

2016 was a very negative year for the restaurant and bar sector in France, as restaurants turnover decreased

by 4% overall (with a collapse of -7% in the 1st quarter 2016 alone) and cafés/bars’ yearly turnover fell by 3.5%.

Germany: restaurants’ turnover keeps rising

As in 2015, the German restaurant sector kept delivering a solid economic performance, with a growth of its

annual turnover of 2.5%, while employment in the sector remained stable (+0.1%). The bar/café sector registered

amoremoderate increase of activity (+0.8% in turnover) while the number of employee decreased slightly (-0.2%).

Italy: restaurants on the rise

2016 was a positive year for the creation of restaurants, as their number grew by 2.6%. The number of cafés/bars

remained however stable (+0.05%)

Spain: robust growth and record number of employees

The positive development experienced in the last few years continued in 2016, as the annual turnover rose for

restaurants and bars by 6.2%. Moreover, the number of employees has reached new records in figures with a

growth of 4.1%, reaching a total of more than 1.2 million workers.

The Netherlands: strong growth in annual turnover

Forecasts for 2016 show a strong growth in turnover in all segments of the sector: +4.2% in the annual turnover

of restaurants, +6% for fast service restaurants and +4.3% for cafés. This matches a similar growth in volume

(+3% for restaurants, +5% for fast service restaurants, +2% for cafés) which should be accompanied by a similar

growth in employment in the sector.

Sweden: +4.4% growth in the sector

The sector performed well with an overall growth in turnover of 4.4% which mirrors a growth in all segments of

the market: +0.8% for hotel restaurants, +4.1% for cafés, +4.5% for fast-foods, +5.9% for lunch/dinner restaurants,

+9.6% for Airports, train stations, highway restaurants and +4% for bars and pubs.

The United Kingdom: solid growth in the sector

Despite a decrease in the number of restaurants, bars/pubs (-2,5%), the restaurant sector grew 8.2% in 2016 and

the pubs and bars sector by 4.9%. Employment in the sector now reached 1.6 million, representing 9% of the UK

employment in 2016.

* Figures for Spain and Sweden aggregated data for both restaurants and cafés

10

5

0

-5

Spain*

Netherlands

Germany

France*

Turnover of restaurants - Yearly evolution in %

Sweden*

UK