18

|

2017

|

2018 HOTREC ANNUAL REPORT

Greece recorded the second largest increase in European RevPAR 2017 with +14.7% growth compared to 2016,

and with an occupancy rate up +3.6 points and an average daily rate up +8.9%. The country is buoyed by the good

results of its capital city: Athens recorded a 17.7% increase in RevPAR over the year.

Spain, the second-largest tourist destination in 2017, posted a RevPAR of +9.6%, resulting from average prices

that rose throughout the year (+7.8%). The destination, known for being inexpensive, posted a 13.2% increase in

RevPAR on the economy segment.

Destinations in the Mediterranean seem, as in 2016, to benefit from the interest of tourists who previously traveled

to Maghreb countries, Egypt or Turkey. 2017 also turned out to be a good year for the Benelux countries: Belgium,

the Netherlands and Luxembourg each surpassed the +10% growth rate for their RevPARs.

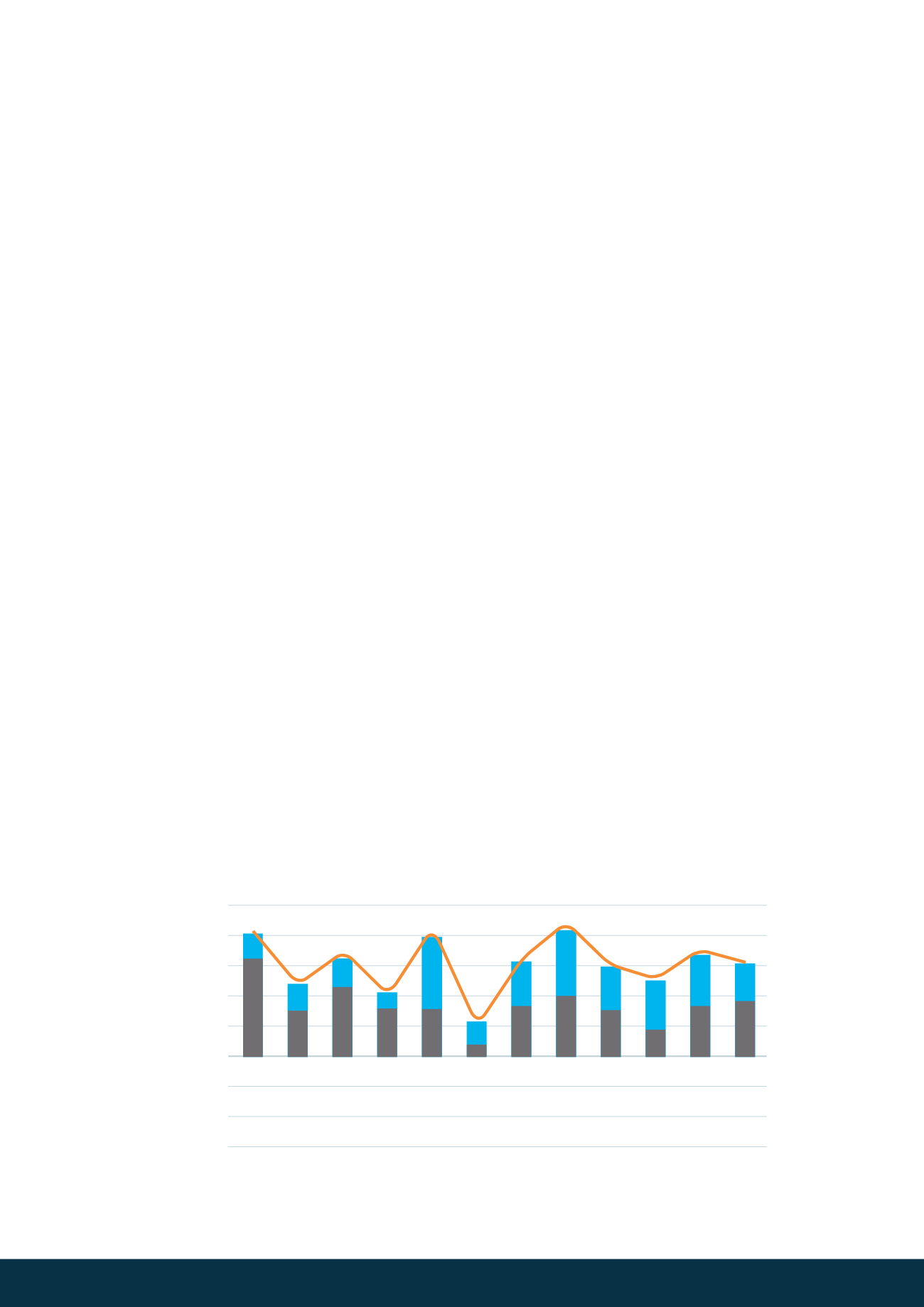

Belgium is recovering from the terrorist attacks that struck the Brussels airport and metro and had negative

consequences on the tourism industry. After a drop in RevPAR by -11.8% in 2016, the country posted a 13.9%

increase in RevPAR in 2017 thanks to a 6.8 point increase in occupancy rate and a 3.2% increase in average daily

rates. It also reports a sharp upturn in the occupancy rate from March 2017, while average daily rates start to

rise from May 2017 and visibly increase at the end of the year, from September to December. In contrast with the

previous year, the capital city posted an occupancy rate of 70.4% in 2017, up 9.1 points and a RevPAR up +17.7%.

The Dutch market performed well throughout the year thanks to a balanced increase in occupancy rate and

average daily rates leading to +10.4% growth in its RevPAR. Double-digit growth in major cities (Amsterdam,

Rotterdam, Utrecht and The Hague) is responsible for this result. RevPAR in Luxembourg also recorded a

significant increase by 12.3%.

Western European countries observe moderate but visible changes in RevPAR. Driven by the good performance

of the cities of Cardiff and Edinburgh (RevPAR growth by +10.9% and +11.5%) and by the dynamism of each hotel

segment, the United Kingdom recorded a 5.6% increase in RevPAR. With +2.1% growth in its RevPAR, Germany

was supported by Cologne (+10.8%) and slowed down mainly by Munich (-2.7%), Nuremberg (-6.7%), Dusseldorf

(-1.9%) and Essen (-4.8%).

In France, the overall RevPAR 2017 reported to 4.9% increase driven by the good performance of the midscale

(+5.7%) and high-end (+5.1%) segments, mainly due to a favorable occupancy rate throughout the year. With an

occupancy rate of 78.7% (+6.3 points) and 8.6% growth in RevPAR, the capital is following a healthy dynamic in

2017.

Eastern Europe also reported a +9.8% increase in RevPAR for Prague, +12.3% for Budapest and +4.7% for Poland.

Warsaw has an occupancy rate of 80.3%, up +1.5 points, Prague has an OR at 80.8% (+2.9 points) and Budapest

an OR of 77.3% (+1.5 points).

Apart from a slight decline in Switzerland’s performance (-0.7% in RevPAR) due to falling prices, the European

hotel sector signed a favorable year 2017, marked by the recovery of the countries affected by the terrorist

attacks of 2015 and 2016. Figures thus point to a brighter future for the continent.

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

01/17 05/17 03/17 04/17 05/17 06/17 07/17 08/17 09/17 10/17 11/17 12/17

■

Changes ADR

■

Changes OR

―

Changes RevPAR